The gross profit margin is the percentage of revenue left after the cost of goods sold (COGS) has been deducted. It is a crucial business metric that illustrates how effectively a company uses its sales revenue to cover its expenses: the higher your gross profit margin, the more money you make from each sales dollar.

A gross profit margin is also critical in business because it indicates how much of your revenue is retained after covering the cost of goods sold and operating expenses.

It tells how well your company is performing and how efficiently you use your sales dollars to make money for your company. The higher the gross profit margin, the better off your company will be.

If you’re a business owner, it’s essential to understand what is considered a good gross profit margin. Gross profit margin is often confused with net and operating margin, but the three terms have different meanings. Let’s dive into the details.

What is Gross Profit Margin?

Gross profit margin measures the profitability of a company’s sales. Gross profit is the difference between revenue and cost of goods sold (COGS), which includes all direct costs associated with producing products or services, such as labor and materials.

The gross profit margin is one of the most important financial metrics for any company. It measures how well it can turn revenues into profits and shows how efficiently a company generates cash from its operations.

A high gross profit margin means that a company’s products are selling at a premium price or that it has a high level of operating leverage (that is, it earns more income on each dollar of sales). A low gross profit margin indicates that the company must work harder to make revenues.

A company’s gross profit margin depends on several factors, including its pricing strategy, the availability of raw materials, and the efficiency of its manufacturing processes. Gross profit margin varies significantly based on industry and product type.

For example, pharmaceutical companies often have very high gross margins due to their ability to control manufacturing and distribution costs through patents. Food manufacturers typically have much lower margins because they don’t own any intellectual property rights over their products. They must compete with many other companies that sell similar items at lower prices than they can charge.

Why Does Gross Profit Margin Matter?

Gross profit margin is an essential metric for any business because it tells you how much money you have left to pay your operating expenses and make a profit.

If your gross profit margin is low, a large portion of your revenue goes towards paying for your COGS, and little remains after covering these costs. This means you’ll need to raise the price of your products or services to maintain adequate profitability or find ways to cut costs so that less money goes towards covering direct costs like materials, labor, and overhead expenses like rent and utilities.

Gross profit margin gives you an idea of how efficiently your business operates. It shows how much money you make per sale (before deducting expenses or taxes).

You can use gross profit margin to compare different companies within the same industry or to compare yourself with competitors in other sectors.

Here are five more reasons why gross profit margin matters:

It measures how much money you make on each sales dollar. The higher your gross profit margin percentage, the more money your business makes on every dollar of sales. For instance, if you have a 50% gross profit margin, you make half of your total revenue as pure profit. This can be a good thing because it allows you to keep more cash in the bank for future investments or expansion efforts.

It shows how much your sales go toward paying COGS and generating profits. Gross profit margin is the percentage of revenue left after deducting the cost of goods sold (COGS) from total sales. It’s an important metric because it shows how much your sales go toward paying COGS and generating profits. The higher your gross profit margin, the more money you make before expenses are considered.

It helps you evaluate whether your product or service pricing strategy works well. Gross profit margin enables you to assess whether or not your product or service pricing strategy works well or needs improvement. For example, if your company has been selling its products at a loss to gain market share, then you might want to increase your prices to make up for that lost money. Or, if you find that some products bring in more profit than others, you might want to focus on those with higher gross margins.

It allows you to compare companies in similar industries. Gross Profit Margin will enable you to compare different company performances in identical industry segments and geographic regions. For example, suppose a company has a higher gross profit margin than its competitors. In that case, it can sell the same products or services at a higher price than the competition in that industry or location.

It helps investors determine whether a company has enough cash flow. t helps investors determine whether a company has enough cash flow to sustain operations over time, even during low sales periods.

If a business has very high gross profits but also has high overhead costs — such as rent, utilities, and other expenses associated with running its operation — then it would be considered unprofitable because its total revenues would not cover all its costs.

If this same business had low overhead costs but lower gross profits, it would still be unprofitable because its total revenues wouldn’t cover all its expenses.

How to Calculate Gross Profit Margin

Gross profit is the difference between the revenue generated by your business and the cost of goods sold. The formula for calculating gross profit is:

Gross Profit = Revenue – Cost of Goods Sold

The purpose of calculating gross profit is to assess the profitability of your business. Gross profit measures what’s left over after you deduct all costs related to making your products and delivering them to customers.

Gross profit margin is a financial ratio that shows the percentage of revenue left over from sales after subtracting the cost of goods sold from total revenue.

The gross profit margin is calculated by subtracting COGS from the gross profit and dividing that number by the net sales. This equals the percentage of net sales retained as gross profit.

The formula follows:

Gross Profit Margin = (Gross Profit ÷ Total Revenue) x 100

Generally, the gross profit margin is a better indicator of profitability than the entire business. A business with total solid sales could suffer losses if high operating expenses aren’t considered. When calculating gross margin, you can determine whether you spend too much time or labor on a particular product or service.

Industry Averages for Gross Profit Margins

Industry averages can vary significantly based on the type of business, but many fall between 5% and 10%.

For example, according to industry analysts from NYU, the average gross profit margin for retailers is around 4%. For Financial Services (non-bank and insurance, it’s about 26%, while Drugs (pharmaceutical) have an average margin of about 19%.

Here is a comprehensive list of average gross and net profit margins by industry from the U.S. Margins by Sector. You can view the complete list here.

| Industry | Gross Margin (%) | Net Margin (%) |

| Advertising | 26.20 | 3.10 |

| Aerospace/Defense | 16.87 | 3.41 |

| Air Transport | 1.41 | -7.66 |

| Apparel | 53.04 | 7.06 |

| Auto & Truck | 14.25 | 3.96 |

| Auto Parts | 15.58 | 1.34 |

| Bank (Money Center) | 100 | 32.6 |

| Beverage (Alcoholic) | 47.99 | 5.07 |

| Brokerage & Investment Banking | 69.46 | 20.34 |

| Building Materials | 28.32 | 8.40 |

| Business & Consumer Services | 31.80 | 4.97 |

| Cable TV | 57.39 | 11.24 |

| Chemical (Basic) | 20.38 | 11.43 |

| Coal & Related Energy | 18.54 | -5.14 |

| Computer Services | 27.24 | 3.42 |

| Computers/Peripherals | 36.88 | 18.72 |

| Construction Supplies | 22.73 | 7.92 |

| Drugs (Biotechnology) | 62.25 | -0.62 |

| Drugs (Pharmaceutical) | 67.35 | 11.03 |

| Education | 47.90 | 7.17 |

| Electrical Equipment | 33.53 | 7.26 |

| Electronics (Consumer & Office) | 32.41 | 7.08 |

| Engineering/Construction | 13.45 | 1.81 |

| Entertainment | 41.94 | 3.86 |

| Environmental & Waste Services | 33.64 | 6.72 |

| Farming/Agriculture | 13.61 | 6.03 |

| Financial Services (Non-bank & Insurance) | 85.08 | 32.33 |

| Food Processing | 27.00 | 8.44 |

| Food Wholesalers | 14.85 | 0.69 |

| Furn/Home Furnishings | 29.74 | 7.64 |

| Green & Renewable Energy | 62.92 | -19.78 |

| Healthcare Products | 59.04 | 12.92 |

| Healthcare Information and Technology | 52.49 | 16.64 |

| Hotel/Gaming | 55.45 | -28.56 |

| Information Services | 53.83 | 16.92 |

Other Types of Profit Margins

Operating Profit Margin

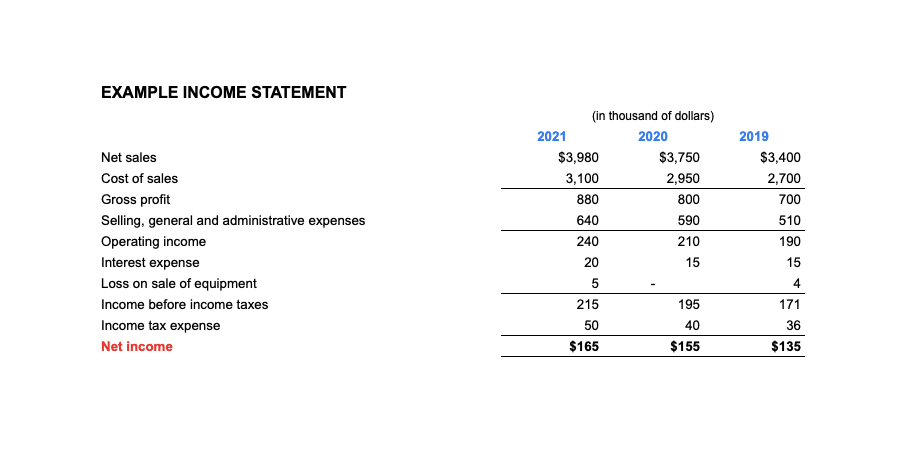

The operating profit margin is calculated by subtracting operating expenses (including selling, general and administrative expenses) and cost of goods sold (COGS) from revenues.

Operating profit is the earnings of a business before deducting interest and taxes, depreciation, amortization, depletion, and other non-operating expenses. The operating profit is also referred to as operating income or earnings before interest and taxes (EBIT).

To calculate the operating profit margin, first, calculate your operating profit:

Operating profit = revenue – the cost of goods sold – operating expenses

Then, you can use the operating profit margin formula:

Operating profit margin = (operating profit ÷ revenue) x 100

Operating income is a crucial metric for measuring a company’s performance. It can be used to evaluate a company’s sustainability in the long run, as well as its ability to generate cash flow. To get a more accurate picture, it’s best to use operating profit or net profit margin.

Net Profit Margin

Net profit is the money left over after you have paid all your expenses and have deducted everything that has to be removed.

All of these expenses are called operating expenses. They include salaries, rent, utilities, supplies, advertising, and other costs that directly or indirectly contribute to the company’s revenue stream, like taxes and interests.

To calculate the net profit margin, use this formula:

Net profit = revenue – the cost of goods sold – operating expenses – interest – taxes

After that, you can calculate the net profit margin using this formula:

Net profit margin = (net profit ÷ revenue) x 100

After COGS, OPEX, interest, and taxes are deducted, net profit is the amount left.

Difference Between Gross Profit, Operating, and Net Profit Margins

Gross profit margin is the difference between revenue and cost of goods sold. It measures how efficiently a company turns its business into profits.

The operating profit margin is the difference between gross profits and operating expenses. It shows how efficiently a company conducts its day-to-day business.

Net profit margin is the difference between revenue and total costs, including all expenses, taxes, and interests. It includes all costs incurred to generate revenue.

Looking at a real-world example is a great way to illustrate the differences between the margin formulas. Here are Amazon’s margins as of March 2020:

- Gross profit margin: 26.06%

- Operating profit margin: 5.29%

- Net profit margin: 3.36%

Since each margin accounts for a little more of your company’s spending, your profits will likely decrease. As a result, your business may suffer a less dramatic drop in gross profit margins than the other margins.

A lucrative global company like Amazon has operating expenses and costs far exceeding those of most small businesses. As a result, they can expect lower operating and net margins.

What is a Good Profit Margin?

Across various industries, the average net profit margin in the United States is 7.71%, according to an NYU report. But that doesn’t mean your ideal profit margin will line up with this.

Generally, a margin of 5% is considered low, a margin of 10% is considered healthy, and a margin of 20% is considered high. An excellent profit margin is at least twice as high as the overall industry average. This means that if a business has a profit margin of 5%, the industry average would be around 2%. When determining whether your profit margin is good, it can be helpful to look at the numbers in this way.

In addition to helping you determine whether or not your profit margin is good, this method also allows you to compare yourself to other businesses in your industry. If you have a lower margin than most other companies in your field, there might be something wrong with your pricing strategy.

You may need to lower your prices to be more competitive with other companies in your industry. On the other hand, if you have a higher profit margin than others in your field, there’s no need for concern — keep doing what you’re doing.

However, a one-size-fits-all approach isn’t the best way to set business profitability goals. First of all, some businesses are inherently high-margin or low-margin. Retailers and grocery stores, for instance, have low margins. Their expenses are high because they must purchase inventory, hire corporate employees and labor workers, facilitate shipping and distribution, and rent more extensive facilities as their sales grow.

Contrary to this, businesses like consulting firms and SaaS companies usually have high gross margins. Businesses like these have fewer operating costs and, in most cases, no inventory. Jewelry stores also fall into this category. Low-margin products like food and some consumer goods tend to sell more efficiently.

Using and Improving Gross Profit Margin

When it comes to a business, the profit margin is significant. It measures how much money your business makes per unit of product sold.

The profit margin can be calculated by dividing the net income by the sales revenue. With a high-profit margin, you can make more money with each sale.

You can improve your profit margin in several ways:

Reduce your overall operating costs: You can lower costs by buying materials at discounted rates, getting better service deals, and using less expensive shipping methods.

Increase prices: Raising your fees may be the easiest way to increase your profit margin. However, this can be risky because some customers will not pay higher costs for their goods or services if they are not worth it. For example, if you raise your prices but don’t improve the quality of your product, then customers may decide not to buy from you anymore and go elsewhere instead.

Increase sales volume: The best way to increase profits is by increasing sales (that is, making more sales). However, this isn’t always easy because many factors affect sales volumes, such as economic conditions and market competition.

Cut underperforming products or services: If you offer several different products or services, ask yourself if they all provide value for money. If one product generates sales but doesn’t contribute much profit, consider dropping it from your range until things pick up again.

Add higher-margin products or services: If your products or services have a high markup, you’ll make more money on each sale. You can increase prices or choose more expensive products than their competitors’ offerings.

Adjust your pricing strategy: If you sell products, you can adjust your prices to increase the profit margin. For example, if you’re selling a product with a cost price of $10 and a retail price of $20, you can reduce the price to $5 and increase the retail price to $25. That way, you make more money per sale. If you’re unsure what price point will work best for your customers, talk with your accountant or another financial professional who can help you through this process.

Get better deals on supplies and materials: When it comes to increasing profits, every little bit helps. That’s why it’s essential to look for ways to get better deals on supplies and materials needed for your business operations. You might be able to negotiate better terms with suppliers or find lower-cost alternatives that will still meet your needs just as well as name-brand goods.

Build brand loyalty: A customer who’s loyal to your brand will buy more of your products and won’t go elsewhere when they need other things. This means you’ll have less competition and less risk of losing customers to competitors. Loyal customers also make fewer returns, which can help reduce costs associated with refunds or exchanges. You may also see increased sales because customers like your brand tend to refer others to you.