A financial statement is a report that summarizes transactions, such as sales or expenses, and shows the financial condition of a person or organization. It’s a simple way to get helpful information about your finances in one place.

Financial statements are generally organized into four basic financial statements. These include a balance sheet, an income statement, a cash flow statement, and a statement of retained earnings.

It’s essential to understand the information on your financial statements so that you can track how your investments are doing. Having a good understanding of what the numbers mean, and looking for trends over time, will help you make more informed decisions about your finances.

Table of Contents

ToggleThe Four Basic Financial Statements (And Why They Matter)

Financial statements are reports that show a company’s financial position over a specific accounting period. They show how much money is coming in and what money is going out of the business. All businesses use these four financial statements to measure their performance and the results of their operations.

These documents help you understand your business better, but they also help creditors, investors, and other interested parties understand your business and make predictions of its earning potential.

Each statement provides a different point of view, but they all work together to form one complete picture.

Balance Sheet

The Balance Sheet is a snapshot of a company’s financial position at any given moment — it reports what a company owns (its assets), what it owes (its liabilities), and its net worth (assets minus liabilities). The Balance Sheet is also sometimes called the Statement of Financial Position.

It tells you how much money the company has on hand and how its financial situation compares to when it was last examined.

The balance sheet is the heart of a company’s financial statements because it tells you if it is in good shape or in danger of bankruptcy.

Key Features of the Balance Sheet

When looking at a balance sheet, you will see three key features: assets, liabilities, and equity. These three sections contain information about your company’s financial position on a given day.

Items Included in the Balance Sheet

Assets

Assets: The balance sheet’s asset side shows various things that belong to your organization. Assets are grouped into current assets and noncurrent assets. Existing assets are resources that can be converted to cash within one year, such as cash on hand, accounts receivable (i.e., money owed by customers), inventory, and prepaid expenses (e.g., insurance).

Noncurrent assets are resources with values lasting beyond one year and include long-term investments, fixed assets (e.g., machinery), intangible assets, and deferred charges.

Liabilities: Liabilities are the debts and obligations of a business, such as loans, accounts payable, and accrued expenses. Liabilities can be short-term or long-term.

Current liabilities are debts that must be paid within one year. Examples of current liabilities include accounts payable, interest payable, income tax payable, and short-term loans.

Long-term liabilities are debts that mature more than one year in the future. Long-term liabilities include bonds payable, mortgages payable, and long-term notes payable.

Equity: Shareholders’ equity is the net difference between assets and liabilities. After accounting for everything owed, the equity section sums up assets minus liabilities and shows what you own. Equity can be damaging if liabilities exceed assets, called a deficit.

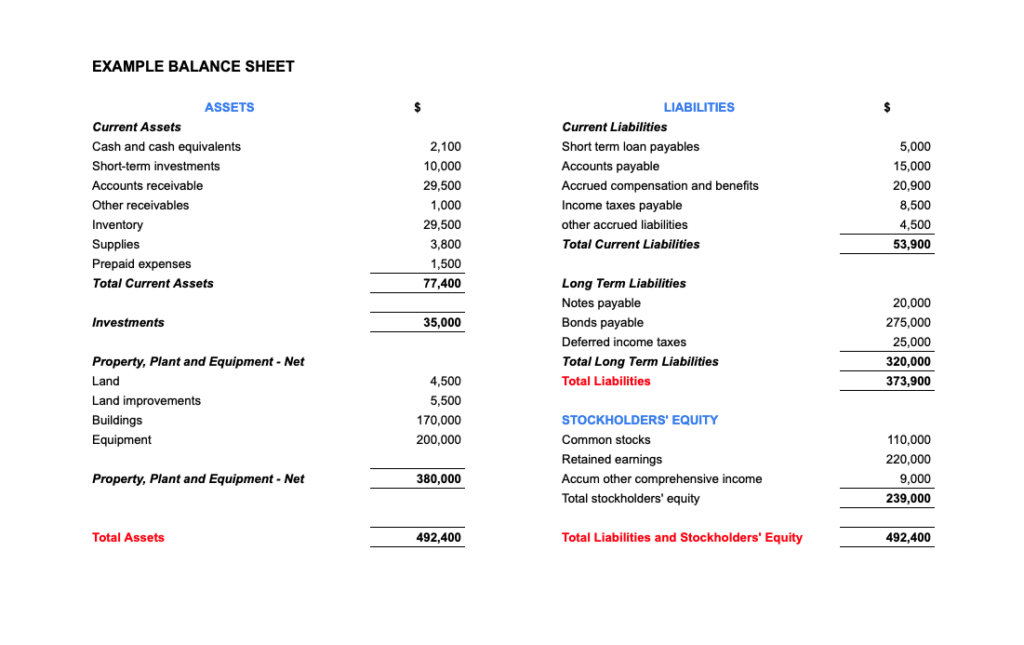

Example of a Balance sheet

A balance sheet is typically divided into three sections, starting with assets on the left side, then continuing with liabilities, and ending with the net worth on the right side.

This sample balance sheet shows how the balance sheet is typically laid out, the items reported, and how it differs from other statements.

Income Statement

The Income Statement measures the business’s profitability over time. It has two major parts: income and expenses. When added together, these components equal net income for the period. The Income Statement is also sometimes called the Profit & Loss statement.

This is the most popular financial statement because it shows whether a company made or lost money during a specific period, like a month or year. The Income Statement shows you what happened to your money over a period (typically a year). In contrast, the Balance Sheet is concerned only with where your money is at any given moment.

One of its purposes is to help investors gauge how well a company is performing by comparing expenses against revenue. If a company has more expenses than revenue, it loses money; if it has more income than expenses, it makes money.

Key Features of the Income Statement

The income statement is a document that summarizes the revenues and expenses of an organization over a given period. On it, you’ll find three key features: revenue, fees, and net income. These three features tell you how well your company is doing financially over a given period.

Items Included on the Income Statement

Revenue: The total income of a company refers to the total amount of money brought into the company. It represents all sales generated in a given period, such as one quarter or one year. Revenue includes all money a company receives from its customers, whether it’s cash, checks, or other forms of payment.

Expenses: Expenses are the costs incurred while generating revenue. Expenses can be broken down into four main categories:

Cost of Goods Sold (COGS). After subtracting its direct costs such as materials, labor, and shipping, this is the profit a company makes.

Operating Expenses. This covers payroll, rent, utilities, and other things that aren’t directly related to production or sales. These are generally fixed costs that are relatively consistent from month to month.

When a company borrows money, there’s interest to pay on those loans. Since this is an expense, it gets added here. These costs depend on how much the company has borrowed and the interest rate.

Taxes. The government expects its share of profits from companies, and those taxes are recorded here.

Net Income: Net income is the money you have left after you’ve paid all your business expenses. It’s also called net profit or the bottom line — which is why it shows up last on the income statement.

Start with your gross revenue and subtract your business expenses to calculate net income. You’ll end up with either a positive or negative number. If you have a positive number, that’s how much money your business made during the period covered by the statement. A negative number indicates a loss.

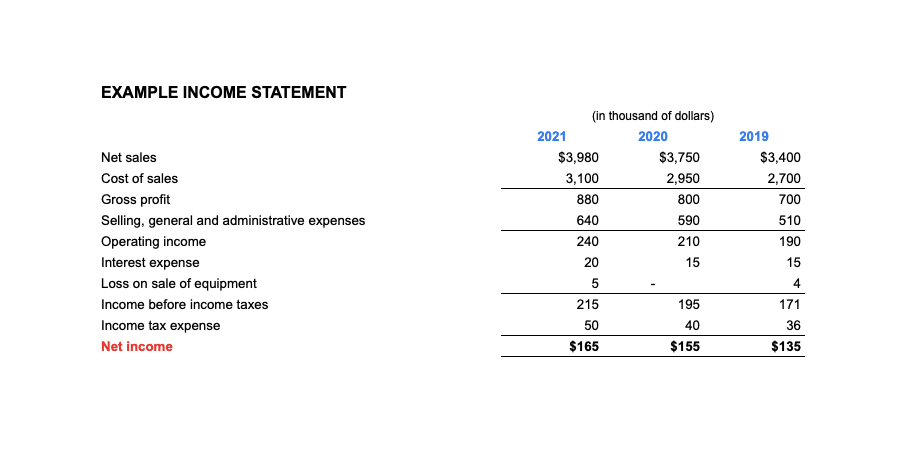

Example of an Income Statement

This sample income statement shows the income statement is typically laid out, the items reported, and how it differs from other statements.

Cash Flow Statement

The cash flow statement looks at how cash moved during a particular period — usually over one year. It shows changes in cash from operating activities, investing activities, and financing activities. It offers an overview of how well a company generates money to fund its operations, pay its debt, and support its investments.

For investors, the statement of cash flows can be significant, as it shows how much actual cash moved in and out of the company during the reporting period. The information is intended to give investors and other stakeholders an idea of how well a company is using its money, and it’s also a good way for companies to stay accountable to their shareholders.

Key Features of the Cash Flow Statement

The statement of cash flows groups together cash-related activities under three main sections: operating activities, investment activities, and financing activities. These sections tell you the overall state of your company’s cash flow.

Items Included in the Cash Flow Statement

Operating Activities: The operating activities section reports activities that involve your company’s core business operations. This includes revenue generated and expenses incurred in the day-to-day operations of your business. For example, a software company would consist of all billing for licenses sold to customers and payments made to employees and third-party contractors.

Investment Activities: After paying all the expenses incurred while running its business, a company has to generate additional revenue through investments to keep itself afloat. These activities include all investments made by the company in other companies (through stock purchases or loans) or its own business by purchasing property, equipment, etc.

Financing Activities: Financing activities are how funds enter the business and how they leave—in other words, how capital is raised and paid back. Investing activities are also transactions related to acquiring or disposing of assets—for example, if a company buys new equipment for the company, that transaction would appear in this section. Investing activities can also include making loans to other companies as well.

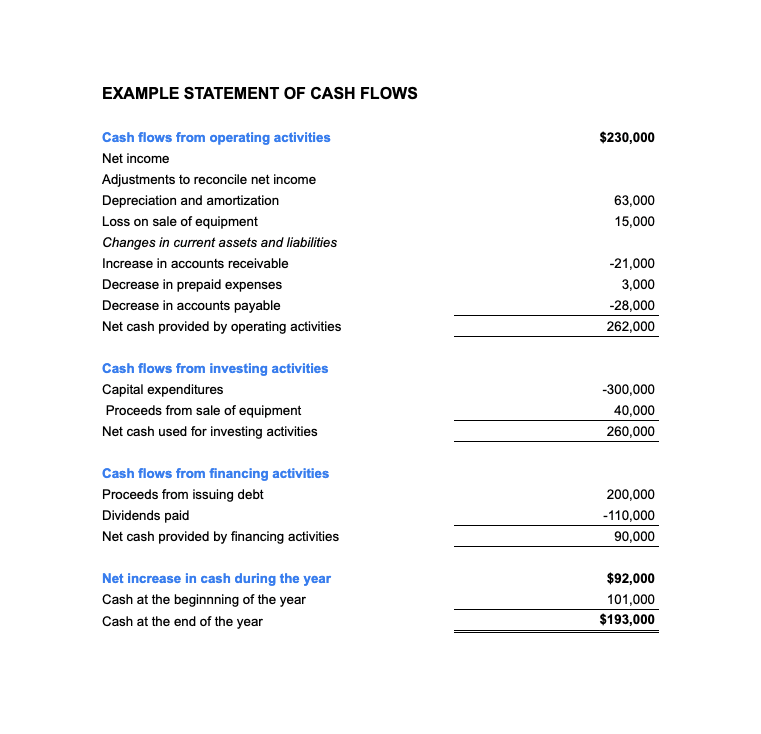

Example of a Cash Flow Statement

This sample cash flow statement shows the income statement is typically laid out, the items reported, and how it differs from other statements.

Statement of Retained Earnings

The statement of retained earnings also referred to as the statement of owners’ equity, is a financial report that details what portion of a company’s profits have been kept over a given period. Retained earnings are the portion of earnings that a company keeps rather than paying out to shareholders. They are part of the equity section of a company’s balance sheet.

The statement of retained earnings is not as widely used as other financial statements, such as the income statement, balance sheet, and cash flow statement. It is usually combined with one or more of these statements into a single report.

Investors need to understand how much money the company is retaining instead of distributing, as this represents future investments that can be made into new projects and ventures. This amount also represents earnings that have not been paid out and are available for reinvestment or distribution.

Items Included in the Retained Earnings Statement

The statement of retained earnings usually appears on the balance sheet as part of the stockholder’s equity and is generally prepared after an income statement and before a balance sheet. This is done to compute the retained earnings at the end of a period reported on the balance sheet—a component of stockholders’ equity.

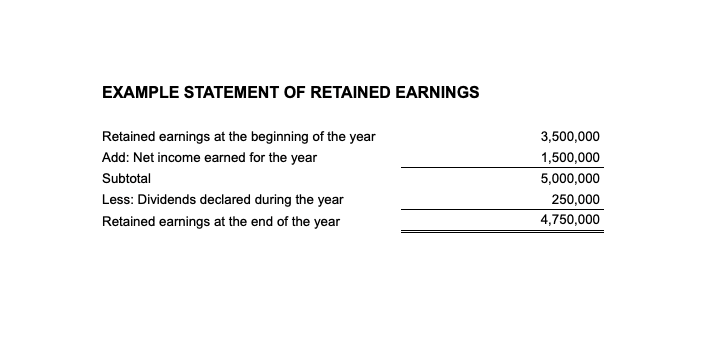

Example of a Retained Earnings Statement

This sample statement shows how the retained earnings statement is typically laid out, the items reported, and how it differs from other statements.

Bringing It All Together (Why You Should Review All Statements)

When you’re running a business, keeping track of finances is critical. You need to know where the money is coming from, where it’s going and what’s left over at the end of each period.

You need to prepare four basic financial statements: balance sheets, income statements, cash flow statements, and shareholder equity statements. Some people refer to these as “books,” and you can use them to get a quick read on your firm’s financial health.

These financial statements are essential for several reasons. You’ll need accounting reports to comply with government regulations or file tax forms in many cases. Different agencies will require various statements, but they generally revolve around these four concepts.

In addition, the statements help you analyze how your company is performing over time and compare that performance with other companies in your industry. This information can help guide decisions on everything from next year’s budget to whether or not your company should pursue a merger or acquisition strategy.

Finally, if you want to borrow money or invest for any reason, lenders and investors will usually require some type of accounting report to evaluate a company’s financial health.

No comment yet, add your voice below!