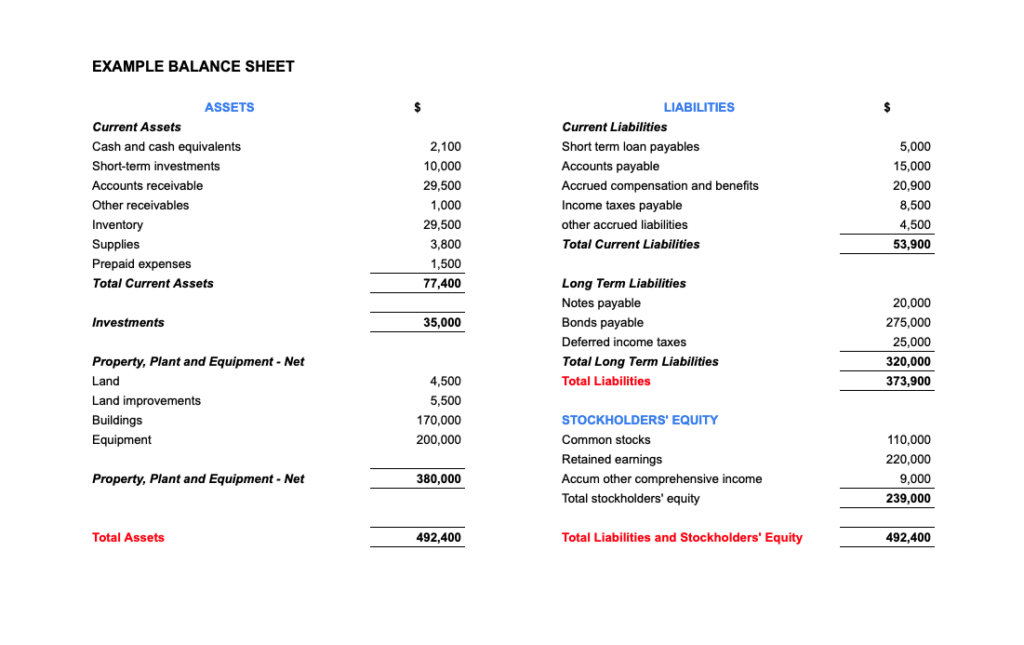

In accounting, there are two basic types of accounts: assets and liabilities. Assets are things that you own, such as cash or equipment. Liabilities are things that you owe, such as a mortgage or debt.

Accounts payable and accounts receivable are two types of those accounts that businesses must manage. Nearly every business must deal with accounts payable (A/P) and accounts receivable (A/R). A/P and A/R are part of your company’s general ledger, where all accounting transactions are recorded for your review.

Accounts payable lists all the bills you incur but have not yet been paid. It is money owed to vendors, contractors, or other parties that have provided goods or services to your business;

Accounts receivable is the list of companies or individuals who owe you money (your customers). It is money owed to you by clients who have paid for services rendered by your business.

Because these two terms are so closely related, it’s common for people to confuse them. This article will give you a better understanding of the two terms.

What Are Accounts Payable?

Accounts payable is an account on your balance sheet representing money owed to vendors and suppliers. It includes the cost of operating your business: paying employees, utilities, and office supplies; buying inventory; and paying rent.

You may also owe money on credit card purchases or loans from banks or other financial institutions.

In accounting terms, accounts payable are considered current liabilities because they are due within one year (or less). Existing assets include cash on hand and inventory; current liabilities include accounts payable and short-term loans.

In most cases, AP departments handle all business transactions involving goods or services purchased from outside vendors.

These transactions include issuing checks for invoices received from vendors, paying invoices electronically through financial institutions or ACH networks, and ensuring all payments are recorded correctly in accounting software such as QuickBooks Online or Xero.

How Accounts Payable Works

Suppliers usually submit invoices directly to an accounts payable department within your company. The invoice contains detailed information about what was purchased and how much should be paid.

When you purchase goods or services from another company, you may have 30 days to pay for them.

If the business owner doesn’t pay within 30 days, they are considered late, and the supplier can apply penalties. In addition to late fees, interest charges may be used if payment is not made within 45 days of receiving the invoice.

The account payable process begins with vendors sending invoices to their customers, i.e., your company. They expect payment within a specific time — usually 30 days — after receiving the invoice.

You must record these invoices in your accounting system and send payment to your suppliers as soon as possible while complying with their terms and conditions, i.e., ensuring that all invoices are paid on time.

When To Use Accounts Payable

The accounts payable function is critical to any business’s accounting system. Accounts payable (A/P) is the account that tracks all of your company’s bills, including credit cards and loans.

The goal of A/P is to ensure that you only pay for expenses after they’ve been incurred. If you’re paying a bill after it’s due, you’re not following best practices.

There are some situations where you might want to pay an invoice early. However, these exceptions are rare and should only be used in exceptional cases.

Generally speaking, there are four main reasons why businesses will want to use accounts payable:

Preventing late fees: If your company pays its bills late, it could incur fines or penalties from its vendors — mainly if it owes them money for more than 30 days (the legal maximum). Using A/P software can help ensure that your company pays all vendors on time so that it never has to worry about being penalized for late payments again.

Tracking expenses. Your business may need to track the costs to stay on top of your cash flow. This is especially true if you’re a start-up or small business with many fixed costs and little capital. Tracking payments can help you manage your cash flow by letting you know how much money is coming in and going out at all times.

You are preventing fraud. By using accounts payable, you can ensure that no one within your company is stealing from the company by making unauthorized purchases. If someone wants to purchase without approval, they can’t use a check or debit card because they won’t have access to those funds unless they get permission from someone else in the company first.

You are managing cash flow. The other reason why businesses may want to use accounts payable is to manage their cash flow effectively. Suppliers often require payment before they deliver goods or services, so if you wait until after delivery to make payments, you’ll need substantial working capital to cover these expenses. Instead, businesses should keep their accounts payable low by making payments as soon as possible after receiving invoices from suppliers.

The best time to use accounts payable is when you receive an invoice from a vendor or supplier. You should enter the invoice into accounting software such as QuickBooks as soon as possible after it arrives so it doesn’t get lost in the shuffle.

Then, when it comes time to pay the bill, you can enter it again into QuickBooks as an expense or a reduction in accounts payable. This way, everything stays synchronized between the two versions.

Examples of Accounts Payable

Accounts payable lists all the money owed to suppliers, investors, and creditors. Here are some examples of accounts payable:

Suppliers: Invoices from suppliers who deliver goods or services on credit terms (typically 30 days). You must pay these invoices within the agreed period or risk losing valuable business relationships with them.

Rentals: This includes rent for office space and other facilities used by your business, such as equipment, property, and vehicles owned by third parties but leased out by them to your company on credit terms (typically 30 days). If rental payments are overdue by more than 60 days, landlords may consider terminating the lease agreement with you.

Services: Invoices for services provided to your business. This could mean anything from office cleaning to landscaping. It doesn’t stop there; the list is long from HVAC repair, repair and maintenance, and more.

Accounts Payable vs. Notes Payable

Accounts Payable (A/P) is a type of liability that occurs when a company buys goods and services from other companies. The company purchases these goods and services with its own money and must pay for them within a month to a year. This can include invoices for supplies, equipment, raw materials, and other items companies purchase on credit.

Notes Payable is another type of liability representing money borrowed by a company from someone else and must be paid back.

Purchasing a building, obtaining a company car, or receiving a bank loan is all notes payable. Notes payable are commonly used as financing when cash is tight, and demand for goods and services is high.

An agreement between two parties outlines terms for repayment of a loan or advance money.

Notes payable refer specifically to promissory notes issued by corporations and other businesses for financing purposes, such as mortgages and other loans taken out by companies with banks or other financial institutions.

What Are Accounts Receivable?

Accounts receivable (A/R) are funds owed to a company from customers who have purchased goods or services on credit. A company’s AR balance is an important indicator of its health and viability.

The balance in accounts receivable includes the total amount owed by customers for products or services that have been provided but not yet paid for.

It does not include cash advances, which can be made to customers when they purchase goods or services on credit and are immediately paid back by the customer through automatic withdrawals from their bank accounts.

Businesses generate AR by selling products or services on credit to their customers. If a company sells a product or service on credit, it will invoice its customer at the time of sale.

This invoice lists the amount owed by the customer, along with payment terms such as net 30 days (30 days from the invoice date). The invoice also includes other information about the transaction, such as itemized details about what was sold and when payment terms began.

Accounts receivable are created when customers purchase goods or services from a company and pay for them later. The company records these purchases as sales on its books but does not collect the cash immediately. Instead, it waits until the customer pays the invoice before registering the payment as revenue.

How Accounts Receivable Works

When your customers pay for their goods or services using credit cards, checks, or electronic payments like PayPal, the money goes into a particular account set up for each customer. This account is called “Accounts Receivable.”

For example, if you have five clients who owe $5,000 each in accounts receivable, you have $25,000 in funds receivable total. You should list this total on your balance sheet under “Accounts Receivable.”

An excellent way to keep track of these accounts is using an Excel spreadsheet or software like QuickBooks Online. You can list all your outstanding invoices and track how much each client is.

When To Use Accounts Receivable

Accounts receivable are great for tracking the money you have coming in from your business. This can ensure that you meet your profit goals and have enough cash flow to continue operating without worrying about going bankrupt.

The most common reason to use accounts receivable is to track customer payments. You can use this information to determine whether your business is profitable and if you need to offer discounts or other incentives to encourage settlement promptly.

For example, suppose you discover that 15 percent of your customers are delinquent in their payments. In that case, you may decide it’s worth offering a discount for early compensation to incentivize them to pay sooner rather than later.

This can help reduce the amount of money that remains outstanding in accounts receivable and increase profitability for your company.

Any business owner must have a healthy balance between accounts receivable and accounts payable.

If you have too much money and no incoming cash, you will eventually run out of money and be forced to close up shop or declare bankruptcy. On the other hand, how can you pay off your bills if no money comes in from sales?

This is why it’s essential for small business owners to always keep an eye on their A/R and A/P balances so they know where they stand at all times.

Examples of Accounts Receivable

Accounts receivable are the money customers owe you for goods or services that you have provided to them.

Accounts receivable are a significant source of working capital for most businesses. Here are some examples:

A retail store has accounts receivable from customers who purchased goods on credit. The store keeps track of these amounts in its accounting records and pays interest on them until the customer pays in full.

A doctor’s office bills patients for medical services after they receive treatment. If the patient doesn’t pay within 30 days, the doctor can deduct the amount from his next bill.

A construction company bills clients after completing a project. It keeps track of these amounts in its accounting records and typically charges interest until they are paid in full.

Accounts Receivable vs. Notes Receivable

Accounts receivable and notes receivable are both a form of financing. The main difference is the underlying transactions.

Accounts receivable is a type of asset representing money owed to a business. It includes amounts owed by customers for goods or services already received and for which payment has been made on an invoice. Accounts receivable refer to debtors being accountable for compensation because they have agreed to pay. This means they have authorized payment and are responsible for paying the invoice in full upon receiving it.

A note receivable is a promise to pay a specific amount when it becomes due and payable.

A note receivable is similar to an IOU, except that a bank may issue it and have specific terms attached (such as interest) instead of an individual. A promissory note is usually in writing, so there is no confusion about what was promised when it was and how much it should cost.

Accounts Payable, Accounts Receivable, and Working Capital

In a business, cash is the lifeblood of operations. Without enough cash, you won’t be able to pay your bills and keep your doors open. Even if you’re a one-person operation with no employees, you’ll need cash to buy supplies and pay for services rendered by others.

Working capital is a business’s funds to invest in its operations, pay debts and other liabilities, or distribute to shareholders. Working capital is the difference between a company’s current assets and liabilities.

The formula for working capital is:

Working Capital = Current Assets – Current Liabilities

In calculating working capital, you need to know the difference between current assets and current liabilities. Current assets include:

- Cash (cash on hand or in a checking account).

- Accounts receivable (money owed to a company by customers).

- Inventory (goods that are ready for sale).

- Prepaid expenses (items purchased in advance).

Current liabilities include accounts payable (money owed to vendors or others), interest-bearing debt (loans with interest payments due), and taxes payable (federal income taxes).

Working capital is an essential factor in the success or failure of a business. It is the difference between what a business has and what it owes. Working capital measures how well a company uses its assets to generate earnings.

The amount of working capital a company requires depends on its industry and the stage of its life cycle. Companies in growth stages typically require more working capital than established companies that have reached maturity.

Working capital requirements increase as companies grow because they have more inventory to finance and more accounts receivable to pay off before receiving customer payment. In addition, companies are more likely to incur short-term debt when sales are increasing rapidly or if their products have high returns on investment (ROI).

Accounts payables and receivables likely make up the bulk of your current liabilities and assets, so effectively managing the two is key to having sufficient working capital.

Days Sales Outstanding and Days Payable Outstanding

Days Sales Outstanding (DSO) measures how long it takes an organization to collect its receivables. It is calculated by dividing the average accounts receivable balance by daily revenue.

The higher the DSO, the longer it takes to collect money owed to the company. This metric can predict future cash flow problems and may indicate that a company is having difficulty collecting customer payments.

To calculate your DSO, divide your total accounts receivables by the total number of credit sales. Then, multiply the results by the number of days for the corresponding period (month, quarter, year, etc.).

Days Payable Outstanding (DPO) are accounts payable days or invoice days. It measures how long it takes an organization to pay its suppliers. The same formula applies: divide the average total payables balance by the average daily payment.

Applying Days Sales Outstanding and Days Payable Outstanding

Days Sales Outstanding (DSO) is the days from selling goods or services to collecting cash from customers. Days Payable Outstanding (DPO) is the number of days between when a business receives payment for goods or services and when it pays its suppliers.

Determining DSO and DPO can help you understand how long your customers take to pay you and how long it takes you to pay your suppliers. The higher your DSO or DPO, the riskier it is for your company. You should work with your accounts payable team to reduce these numbers as much as possible if they are high.

Which is More Important, Accounts Payable or Accounts Receivable?

Accounts payable is the money you owe to your suppliers. Accounts receivable is the money your customers owe you. Good account records are essential because they affect your business’s cash flow.

The answer to this question depends on your business.

For example, if you’re a small business owner with no debt and all cash in hand, you probably don’t need to worry about accounts receivable.

If you’re a large corporation with thousands of suppliers and vendors and millions in outstanding invoices, then accounts payable is a critical financial function that needs to be managed carefully.

In other words, it’s not an either/or situation; accounts payable and accounts receivable are essential.